Payroll services to support your business

Benefit from payroll solutions, expertise and unified technology.

ADP’s international payroll solutions rewarded

Discover ADP’s international payroll solutions

The benefits of ADP payroll solutions

Payroll management is our expertise, and our certified payroll professionals are available to advise and support you. We offer regional and local experts in payroll processing. They understand the requirements and implement payroll in a constantly evolving regulatory environment. ADP payroll services help you:

Overcome the complexity and risk of sourcing, managing and delivering payroll services.

Unify and standardise your payroll processes into a reference model that helps reduce HR administrative costs.

Anticipate changing laws and regulations, while managing differences in time zones, currencies and languages.

Gain a single view of workforce data for reporting and analysis, improving fact-based decisions.

Payroll solutions that scale as you grow

ADP provides flexible payroll solutions that help simplify payroll, so you can scale up or down based on your business needs. We handle the day-to-day complexities and tasks of payroll, so you can focus on running your business.

By providing greater accuracy and seamless integration, our cloud-based technology also provides insights to help you make more informed decisions.

Our extensive network of experts allows us to provide local and global coverage, depending on where your business is located. So you can now effortlessly meet Switzerland’s payroll demands.

As a payroll service provider, we offer:

- Automated, error-free online payroll processing

- Automatic management of payroll statements

- Integration with HR administration, talent, time and analytics solutions

- Access to global workforce data for analytics and reporting

- Partial or complete payroll outsourcing with different levels of service to best meet your needs

- Expert payroll software and payroll, HR and compliance support whenever you need it

- Simplified integration with other systems and applications

Payroll services that align with your strategy

ADP solutions in Switzerland have been designed to support you in your growth locally and/or internationally. The Swiss payroll and HR solution has been designed to easily integrate into our global payroll system.

Payroll for your employees in Switzerland

Automated, compliant, secure, flexible payroll integrated into HR modules.

Payroll for your employees worldwide

A solution to unify and secure your payroll management in more than 140 countries.

See what our clients say about ADP payroll services

We made a decision to move forward with a single vendor for a fully managed, European integrated HCM solution that seamlessly combinesour core HR solutions and ADP owned solutions, while benefitting from ADP’s service and support.

Mandy Muller,

Head of HR Europe

Fujifilm Healthcare Europe

Payroll is so special because payroll is always local, there are no global set rules. This is one of the core areas a provider needs to deliver on and where you have to be adaptable to constantly changing local legislation. Not a lot of players in the market can then deliver on top of that, pan-country standardisations, data processes and systems, and governance — and that’s the added value of ADP.

Nico Orie,

VP, People & Culture Function Strategy and Service

Coca-Cola European Partners

We feel very safe and secure in the fact that ADP’s area of expertise is making sure that these technology platforms are compliant for us. ADP gives us a tremendous sense of comfort and security in knowing that they take responsibility for that with all of our payroll systems.

Penny Cavener,

Senior Director

Celestica

Why our clients choose ADP for their payroll services

According to the 2019 EY Global Payroll Survey, only 26 percent of companies rate the performance of their current payroll service provider as good or very good. Yet, when you work with the right payroll service provider, you can gain peace of mind knowing that you have reduced your risks ; employees will be paid accurately and tax obligations will be settled on time.

ADP offers more options than any other payroll service provider. We’ve lived and breathed payroll for 75 years, and over 1,000,000 clients worldwide trust us to deliver and support modernised payroll processes. With 45 support centres in 140 countries, we’re here to help you unlock the power of payroll management.

Request a demoADP, the reliable partner of Swiss companies

ADP has been operating in Switzerland for more than 40 years. Founded in 1949, ADP currently has over 75 years of experience in the payroll and HR fields. Our teams of dedicated experts support you on a daily basis and share recommendations and best practices; they are themselves backed up by ADP support teams.

Compliance, a daily challenge

Our clients’ payroll and HR teams are faced, in their daily lives, with multiple changes—legal, federal and cantonal (26 cantons)—which must be analysed and then implemented within very short deadlines. Complying with GDPR regulations and Swiss federal law (nLPD) is essential, not to mention complex.

That’s besides the fact that to avoid financial penalties for non-compliance and payroll errors which would impact the social climate of our clients, for more than 75 years ADP has automatically integrated new legal regulations into its clients’ solutions.

Security, a necessity for Swiss companies

Companies are increasingly falling prey to malicious attacks on their infrastructure and sensitive data. In this context, maintaining a high level of security requires additional dedicated skills and presents a real, daily challenge.

ADP focuses on the security and data protection of more than one million clients in more than 140 countries. Our global security teams’ task is to protect client data and the confidentiality, integrity and availability of ADP infrastructure and resources.

How do ADP payroll services work?

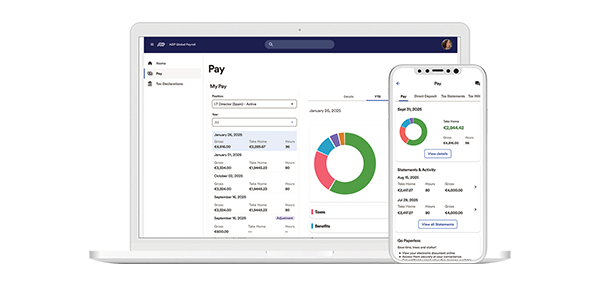

ADP payroll services support partial or complete management of your payroll with different levels of service to best meet your needs. This runs from processing pay slips to calculating contributions, including the necessary social and legal declarations and ensuring compliance with compliance obligations. ADP payroll services simplify the administrative tasks related to payroll management.

Our solution gives you access to a wide range of payroll-related reporting, with reports and analyses ranging from headcount to labour costs. ADP offers integrated human capital management (HCM) solutions that span the areas of payroll and human resources. These HCM solutions from ADP are flexible enough to easily integrate into HCM ecosystems.

Awards and recognition

Let's find the perfect solution for your business

Talk to Sales: 044 744 97 97

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

FAQs

Your questions about ADP payroll services answered

What is payroll and how does it work?

Payroll can be anything from paying your employees and calculating taxes and deductions, to filing necessary taxes and meeting compliance obligations. Payroll management can be done internally or entrusted to a reputable service provider like ADP. If you decide to outsource your payroll, you can opt for partial or full management models, depending on the size of your business and the degree of control you want to maintain.

What do payroll services do?

Payroll service providers offer a range of services to businesses that do not want to manage payroll in-house. This includes calculating employee salaries, making any necessary deductions such as pension contributions, maintaining accurate records and filing taxes.

What are payroll management services?

If, as a company, you choose to entrust all payroll processes to a trusted external provider like ADP, this is called payroll managed services. You can also outsource your human resources information system (HRIS), so your HR and payroll functions are unified for a comprehensive overview of your business data. This transparency can benefit your operational efficiency and strategic decision-making.

Who needs payroll services?

Does your company have difficulty managing payroll internally? Don’t have the time or resources to recruit, train and retain accounting or HR professionals? You could benefit from outsourced payroll services. You will save the costs of an in-house service and avoid the complexity of reporting to government authorities. Plus, you can say goodbye to manual errors and potential fines for missing compliance deadlines.

Why entrust ADP with the management of my payroll?

In addition to relieving you of repetitive work and freeing up time for you and your staff, our digital payroll solutions combine the best technologies for your payroll and HR management services. ADP keeps up to date with legal and regulatory developments, in order to help you comply and protect you against possible fines and penalties. Our payroll systems also synchronise your payroll data with our HR solutions, such as time management.

Will ADP manage monthly payroll declarations for me?

ADP provides mandatory monthly HR declarations and automatically manages file transfers between public administrations and third parties.

Does ADP integrate time management and activities into payroll?

Yes. In fact, it’s extremely simple to start with payroll and then add services such as schedule, time and activity tracking. We can also integrate with your existing time and activity management solution.

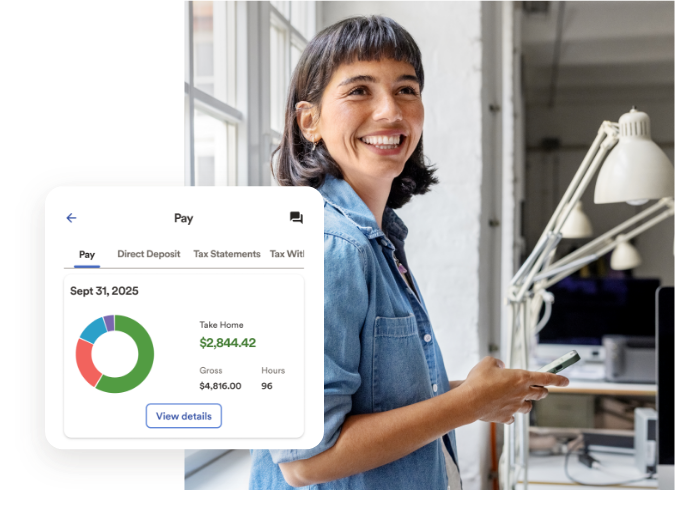

Does ADP have online payroll tools or a mobile app for employees?

ADP’s mobile solutions allow employees to access their payroll and HR information, wherever they are. Employees can perform a range of tasks, such as viewing their payslips, managing their time and attendance, and entering leave requests.

Latest articles & insights

guidebook

What to expect from payroll in 2024

insight

What to look for in a payroll services provider

insight

Why you need one global payroll services provider

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.